19 October 2025

Tools

Whether you’re a developer, system administrator, or just someone working with large sets of files, finding specific text inside files on Windows can be a challenge. While Windows Explorer allows...

27 March 2024

Excel & VBA

Excel's MATCH() and VLOOKUP() functions are powerful tools for finding specific data in a worksheet. However, ensuring these functions are used correctly is crucial for accurate results. One common...

4 February 2024

Excel & VBA

When you copy charts from another Excel workbook/worksheet they still use data from those sources. Here is VBA code that changes their data source to the current workbook.

29 December 2023

Excel & VBA

The article shows how to send a message form Excel to a Telegram group using VBA script.

29 August 2022

Python

The most popular and useful Python libraries and APIs for different free market-data services and sources.

28 May 2022

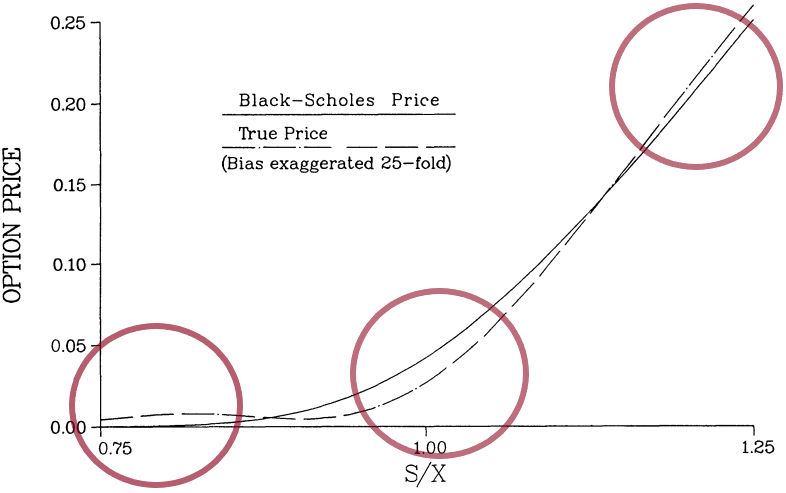

Risk Management

Due to its simplicity, the Black-Scholes-Merton (BSM) model has been widely used by financial institutions and traders for option pricing. However, the BSM model has a number of important...

2 May 2022

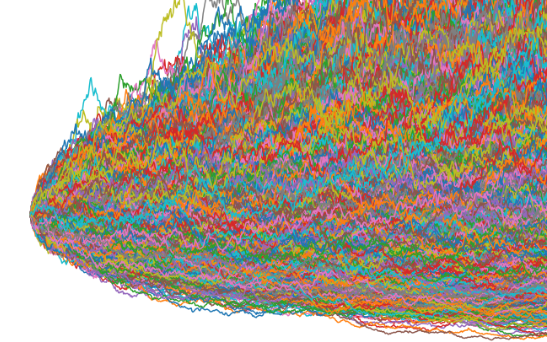

Python

Monte-Carlo simulation is a useful tool to simulate stochastic processes. In this article, I show a simple case of using Monte Carlo in Python to calculate a European option price and compare the...

1 February 2022

Excel & VBA

Useful functions and scripts for everyday Excel&VBA.

7 January 2022

Risk Management

There are several regions with incredibly tense and unstable political situations and high anti-American sentiment. The probability of escalation in some of those regions is relatively high, and...

20 November 2021

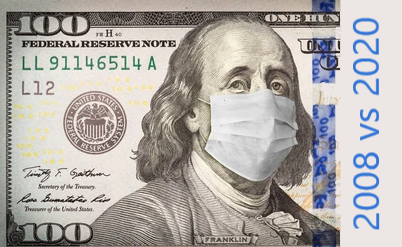

Risk Management

The Global Financial Crisis was a unique phenomenon that not only affected many millions of people and tens of thousands of companies at the time but also impacted the global financial system and...

23 July 2021

Python

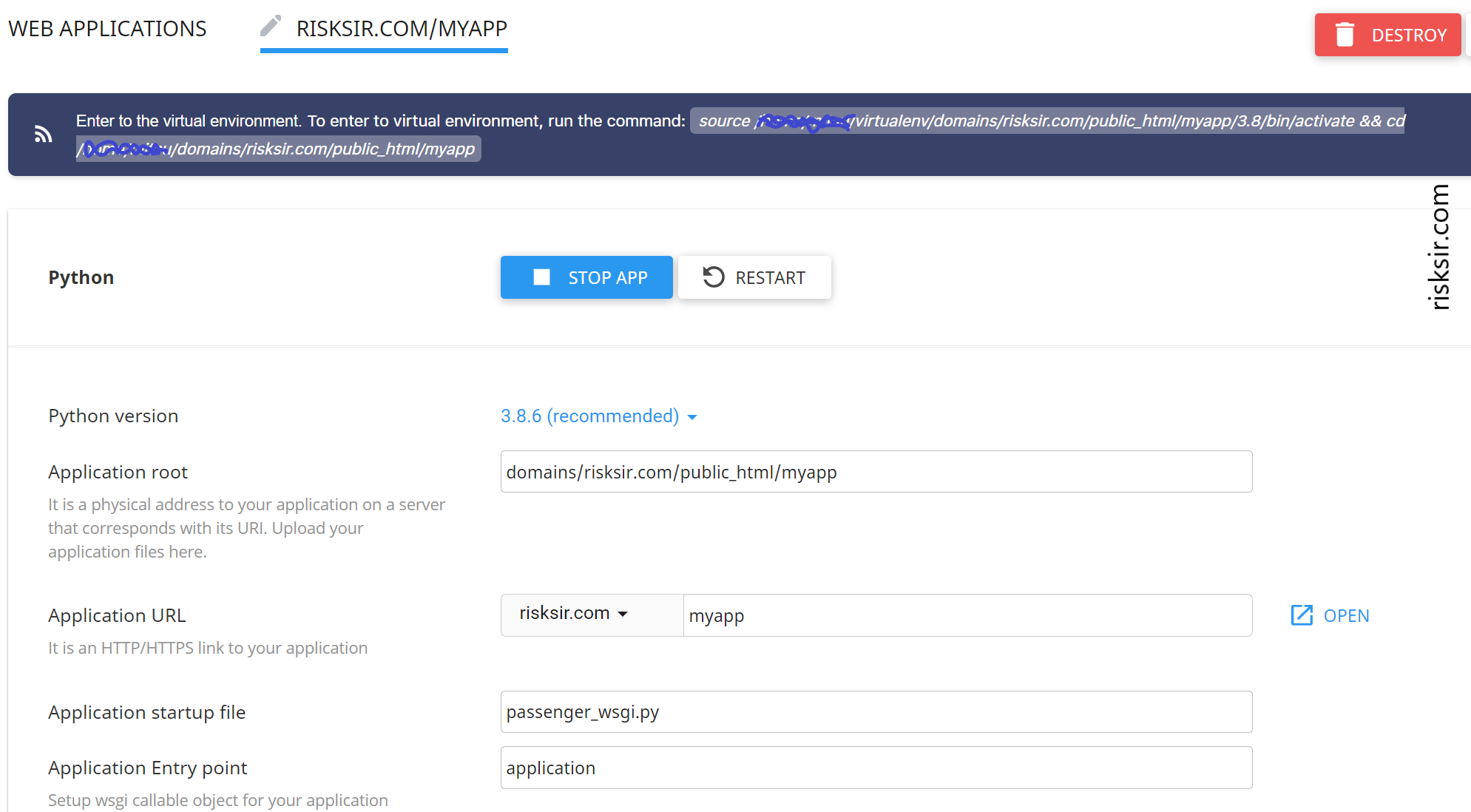

Here is a step-by-step example of how to create a Python app on an Apache virtual hosting and call this app from a php-site.

19 July 2021

SAS

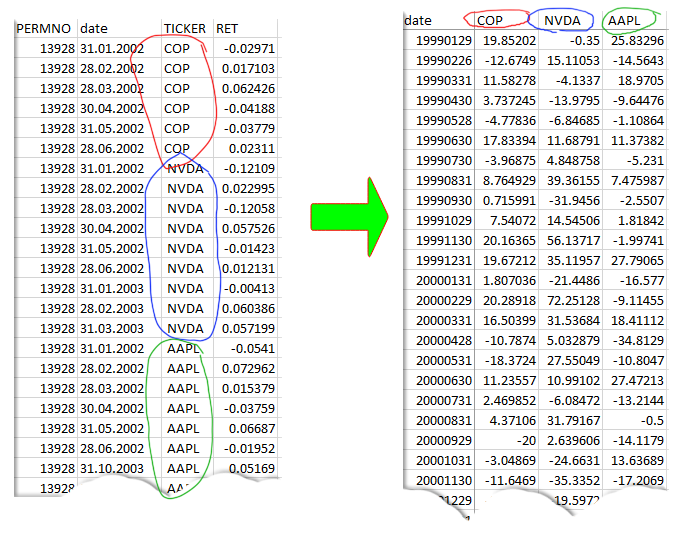

Problem: We have a table of stock returns with columns "Date", "Ticker", "Return", which is not handy to analyse. We need to convert this table to the format "Date", "Ticker1 Return", "Ticker2...